Peer-to-Peer Available Data Sets

Examine Data beyond the 5300

Peer-to-Peer contains many data sources and sets to help your better understand your position in the marketplace, while examining the overall health of the financial industry.

Included Data Sets within Every Peer-to-Peer Subscription

5300 and FDIC Call Reports

All fields and account codes on the 5300 and FDIC call reports can be accessed in Peer-to -Peer and used to create custom reports or peer groups.

ROM - Return of the Member

Our ROM calculation uses 5300 Call Report data to capture a holistic view of a member's relationship with the credit union and focuses on three core functions: savings, lending, and product usage.

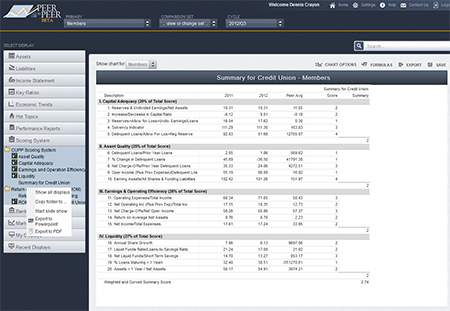

CUPP - Credit Union Performance Profile

CUPP is a system used by Callahan to quantify the key areas of Capital Adequacy, Asset Quality, Earnings and Operating Expenses, and Liquidity.

Econometric Data

The econometric data provides a look at macro-level trends in the U.S. economy and is collected from various sources including the U.S. Census Bureau and Bureau of Economic Analysis.

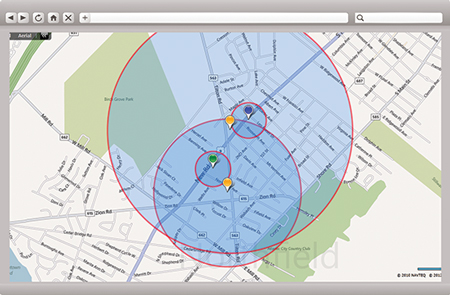

Deposit Data

Peer-to-Peer's Branch Analyzer allows you to track deposit market share and overall performance against financial institutions in a defined market.

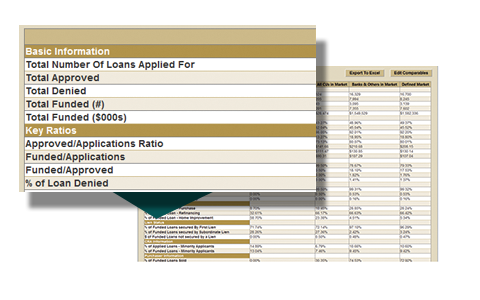

HMDA - Home Mortgage Disclosure Act

Peer-to-Peer's Mortgage Analyzer includes HMDA data that allows you to compare mortgage volume market share within a defined marketplace.

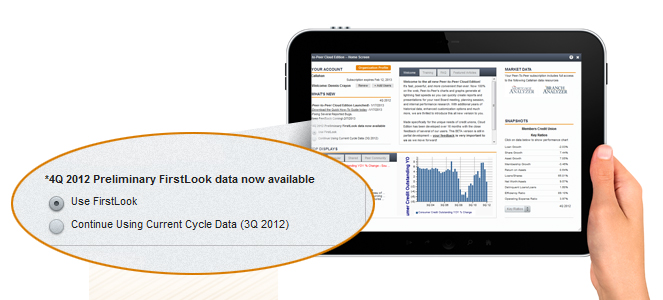

Callahan's FirstLook Program

The FirstLook program in Peer-to-Peer provides you with the opportunity to start your data analysis weeks in advance of the NCUA's official quarterly data release.

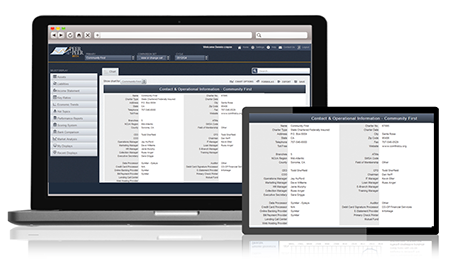

Callahan Proprietary Data

Peer-to-Peer also includes proprietary data such as executive contact names and vendor relationships to help you network with industry leaders.