Peer-to-Peer Financial Performance Analytics for Credit Unions

Fast, Powerful, Convenient

Peer-to-Peer is an in-depth financial analysis and benchmarking resource that helps you accurately and quickly compare a credit union's performance against relevant peers, including commercial banks, using 14 years of historic credit union data and 8 years of bank data.

Analyze Data, Fast

Does it take hours to compile data for your Board or management meetings? We understand your time is valuable. Quickly and easily create professional reports and presentations for your next Board meeting or planning session with Peer-to-Peer.

Dig Deep Into the Numbers

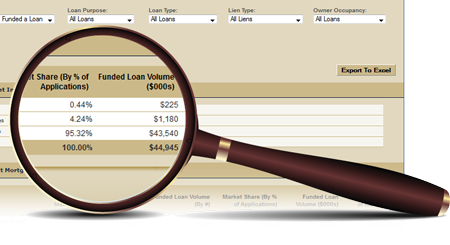

Create charts or pull data scorecards using any account code on the 5300 or FDIC call reports. Peer-to-Peer includes data from a number of sources including NCUA & FDIC Call Reports, econometric trends, Return-of-the-Member (ROM) scores, Home Mortgage Disclosure Act Data (HMDA), and more.

Analyze On-the-Go

Use Peer-to-Peer to quickly pull relevant examples that better communicate your strengths and weaknesses to Board members and staff without having to export and prepare work ahead of time. Whether on the road, at home, or in the office, Peer-to-Peer’s web-based nature allows you to conveniently analyze, view, or share your performance wherever your work may take you.