Market Analysis

Drill Down into Your Local Market with Mortgage Analyzer and Branch Analyzer

Dig deeper into your performance with Peer-to-Peer's market analysis resources designed to help you better gauge your position in your local community.

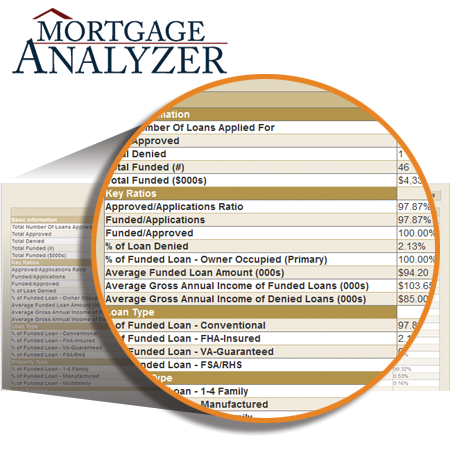

Mortgage Analyzer

Callahan & Associates' Mortgage Analyzer, included in every Peer-to-Peer subscription, uses four years of Home Mortgage Disclosure Act (HMDA) data to provide an in-depth look at your local mortgage lending market and how your credit union stacks up against peers in a selected location.

Identify leading originators in your market while viewing key ratios including denial rates, close ratios, and number of applications attracted. These metrics help put your credit union's relative mortgage lending effectiveness into perspective.

This resource helps you answer questions such as:

- What percent of local mortgage applications are we attracting?

- Who is doing the best job in our local market of moving applications through funding?

- How does our growth (or decline) compare to others locally?

- Are other institutions declining mortgage loans for the same reasons we are?

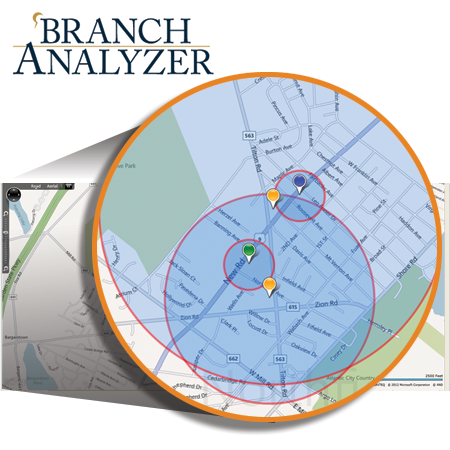

Branch Analyzer

Branch Analyzer allows you to track local deposit market share in any branch location. Whether you want to view a list of a local bank's branches, or you want to see where your credit union falls against peers in your community, you can do all that and more with Branch Analyzer.

Raw data and mapping features let you expand your benchmarking to include the entire market, both banks and credit unions, and more accurately gauge your true competitive environment at the branch level.

This resource helps you answer questions such as:

- Are our branches growing at a similar pace as those in the local market?

- Which institutions have the greatest deposit market share in my community?

- Where should we place our next branch?

Schedule a demo of Peer-to-Peer to see for yourself how Mortgage Analyzer and Branch Analyzer can help you gain a better understanding of your local market.